Why is activity based costing important? Activity-based costing provides a more accurate method of product/service costing, leading to more accurate pricing decisions. And, the activity- based costing process shows you which overhead costs you might be able to cut back on. The activity- based costing ( ABC) system is a method of accounting you can use to find the total cost of activities necessary to make a product. what is Activity Based Costing with example? Allocate costs in secondary pools to primary pools. The first step in ABC is to identify those costs that we want to allocate. What are the elements of Activity Based Costing? They are: Identify costs.

The ABC system of cost accounting is based on activities, which are considered any event, unit of work, or task with a specific goal. what is Activity Based Costing and how does it work?Īctivity- based costing ( ABC) is a method of assigning overhead and indirect costs-such as salaries and utilities-to products and services. Divide total overhead (calculated in Step 1) by the number of direct labor hours. The most common activity levels used are direct labor hours or machine hours. You choose an activity that closely relates to the cost incurred. How is activity rate calculated? The allocation rate calculation requires an activity level. what is Activity Based Costing? Activity- based costing ( ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Number of engineering change orders issued.

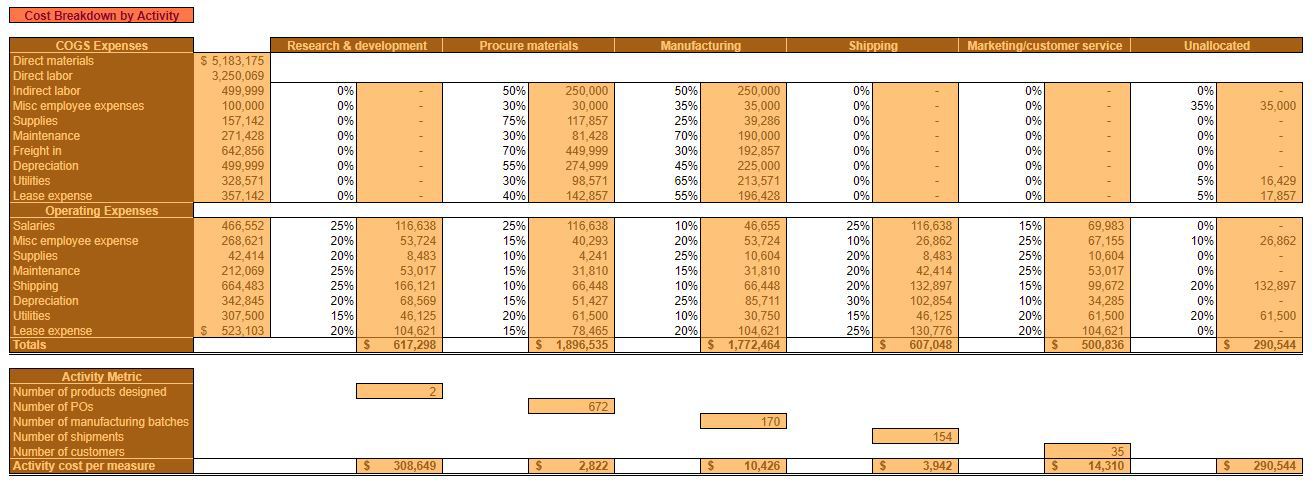

ACTIVITY COST EXAMPLES DRIVERS

What is an example of a cost driver? Examples of cost drivers are as follows: Direct labor hours worked. In other words, it's a way to allocate indirect, overhead costs to products or departments that generate these costs in the production process. Definition: Activity based costing is a managerial accounting method that traces overhead costs to activities and then assigns them to objects.

0 kommentar(er)

0 kommentar(er)